KippsDeSanto & Co. advises Locana, a portfolio company of Transom Capital Group and Angeleno Group, on its sale to TRC Companies, Inc.

/in Aerospace/Defense, News & Publications, Mergers & Acquisitions/by Darren SokvaryKippsDeSanto & Co. advises advises Outside Analytics, Inc. on its sale to SMX, a portfolio company of OceanSound Partners

/in Aerospace/Defense, News & Publications, Mergers & Acquisitions/by Darren SokvaryKippsDeSanto & Co. advises SixGen, Inc., a portfolio company of Chart National L.P., on its sale to Washington Harbour Partners

/in Mergers & Acquisitions, Aerospace/Defense, News & Publications/by Darren SokvaryKippsDeSanto’s DealView – Top 10 M&A Deals of the Quarter

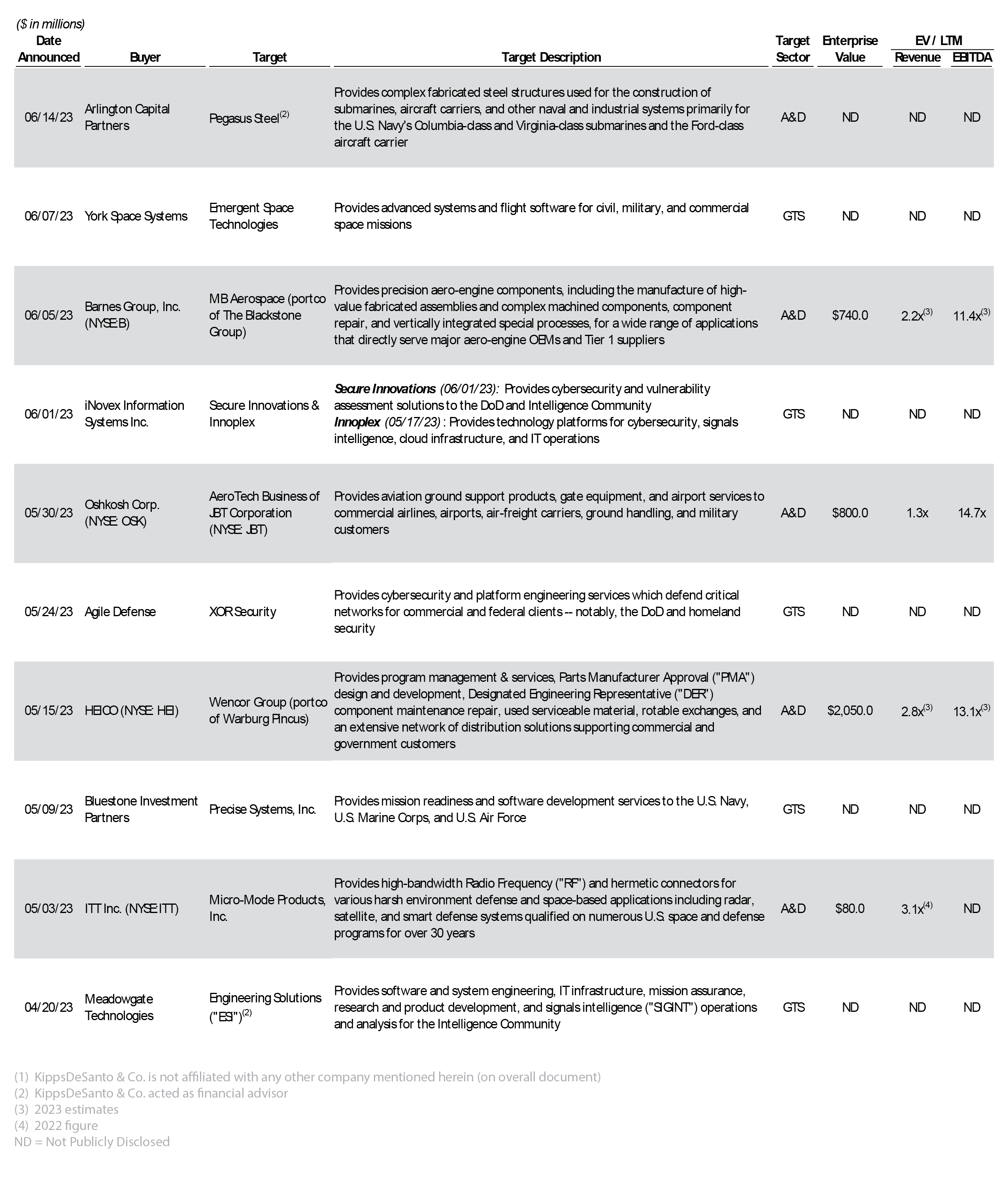

/in Mergers & Acquisitions/by acscreativeKippsDeSanto’s DealView — Top 10 Merger & Acquisition (“M&A”) Deals of the Quarter(1)

KippsDeSanto & Co., an investment banking firm focused on serving growth-oriented Aerospace & Defense (“A&D”) and Government Technology Services (“GTS”) companies, is pleased to share its DealView – the “Top 10 M&A Deals of the Quarter” – for the quarter ended June 30, 2023.

Of the above transactions, we would like to highlight the following deals:

Of the above transactions, we would like to highlight the following deals:

HEICO Corporation’s (NYSE: HEI) pending acquisition of Wencor Group, LLC (“Wencor” or “the Company”) (a portco of Warburg Pincus, LLC). Headquartered in Peachtree City, Georgia, Wencor provides Parts Manufacturer Approval (“PMA”) design and development, Designated Engineering Representative (“DER”) component maintenance repair, program management and services, used serviceable material, rotable exchanges, and an extensive network of distribution solutions supporting commercial and government customers. The Company employs 9,000 employees at 100+ facilities worldwide servicing airline operators, aircraft MRO companies, military agencies, and defense contractors. Wencor has created over 6,000 PMA designs for products that support pneumatics, hydraulics, engines, auxiliary power units (“APUs”), landing gear, cabin interiors, and airframe parts. The Wencor acquisition expands HEICO’s aftermarket product offerings and accelerates the combined company’s growth, innovation, and development of reliable, cost-saving products and services for customers. This transaction reflects HEICO’s strategic investment in capturing aftermarket demand as consumer airline passenger volumes surge past pre-COVID levels and military optempo increases in line with global conflicts—ultimately driving growth in commercial and military aircraft utilization. Wencor employs approximately 1,000 people and is expected to generate ~$724 million in revenue for FY2023. As HEICO’s largest ever acquisition to date, this ~$2.1 billion transaction includes 93% cash and 7% stock consideration, and is subject to regulatory approvals and customary closing conditions before its expected close at the end of calendar 2023.

iNovex Information Systems Inc.’s (“iNovex”) acquisitions of Innoplex, LLC (“Innoplex”) and Secure Innovations, LLC (“Secure Innovations”), which were announced on May 17, 2023 and June 1, 2023, respectively. Headquartered in Columbia, MD, Innoplex provides end-to-end hardware and software systems engineering, information assurance, signals analysis, and wireless technology expertise to national and tactical-level end users in the defense and intelligence sectors. The acquisition of Innoplex extends iNovex’s services into high-performance software engineering, cloud infrastructure, and cyber and signals intelligence (“SIGNIT”). The acquisition of Columbia, MD-based Secure Innovations bolsters iNovex cybersecurity offerings by enhancing the combined entity’s defense cyber operations, systems security engineering, and vulneralbility assessment and penetration testing expertise. With the acquisition of Innoplex and Secure Innovations, iNovex is poised to be one of the largest middle-market technology solutions providers focused on national security interests with over $2 billion in combined prime contracts and over 1,000 employees. The combined entity has an entrenched footprint with national security customers and is well positioned to support the government’s goal of cyber dominance through novel approaches and innovative solutions, including the use of automation to manage its multi-cloud structure.

KippsDeSanto & Co. is an investment banking firm focused on serving growth-oriented Aerospace / Defense, Government Services and Technology companies. We are focused on delivering exceptional M&A and Financing transaction results to our clients via leveraging our scale, creativity and industry experience. We help market leaders realize their full strategic value. Having advised on over 200 industry transactions since 2008, KippsDeSanto is recognized for our analytical rigor, market insight, and broad industry relationships. There’s no substitute for experience. For more information, visit www.kippsdesanto.com.

Securities and investment banking products and services are offered through KippsDeSanto & Co., a non-banking subsidiary of Capital One, N.A., a wholly owned subsidiary of Capital One Financial Corporation. KippsDeSanto is a member of FINRA and SIPC. Products or services are Not FDIC Insured, Not Bank Guaranteed, May Lose Value, Not a Deposit, and Not Insured By Any Federal Governmental Agency.

Industry Week in Review – October 12, 2018

/in Week In Review/by kippsdesantoKippsDeSanto & Co. Industry Week in Review – October 12, 2018

Summary

TransDigm has entered into an agreement to acquire Esterline Technologies Corporation for $4 billion. After key aerospace and defense providers have experienced production issues, the Pentagon is partnering with the Intelligence Community to identify and improve shortcomings in companies’ supply chains. Google has announced it will not submit a bid for the $10 billion JEDI cloud contract due to potential conflicts with its corporate values and IBM files a pre-award protest of the contract. The Government Accountability Office released a report detailing a series of cyber vulnerabilities associated with the Department of Defense’s portfolio of weapon systems.

Aerospace & Defense Update

On Wednesday, TransDigm Group Inc. announced that it had entered into an agreement to acquire Esterline Technologies Corporation for a total consideration of approximately $4 billion. Esterline provides engineered components, sensors, and specialized parts to the jetliner industry. The company has strong customer relationships and is a sole-source supplier of certain parts to Boeing and Airbus. TransDigm’s equity purchase price of $122.50 per share represents a 38% premium to Esterline’s closing stock price the day before the transaction was announced. The acquisition continues a trend of industry leaders paying large multiples to condense their supply chain to achieve cost-saving synergies, and TransDigm hopes the acquisition will strengthen its supply chain, cut costs, and increase productivity.

The Pentagon and the Intelligence Community (“IC”) are partnering to audit domestic aerospace and defense companies’ supply chains to identify and improve shortcomings that could hamper U.S military readiness. The Pentagon is particularly concerned about the industry’s ability to effectively increase weapons production and supply a conflict. Boeing’s recent 737 production issues reinforce the need to ameliorate supply chains, as shortages of various production inputs spanning from metal casting to circuit boards have hindered manufacturers’ ability to meet growing demand. Production issues have affected both upstream and downstream suppliers as key providers such as Spirit AeroSystems, GE Aviation, and United Technologies have all experienced production issues, citing late delivery of materials as a contributing factor to their delays. The Pentagon is incentivizing contractors to elevate their performance by offering bonuses for on-time deliveries and are simultaneously diligently working with industry leaders to foster communication and resolve these issues.

Government Technology Solutions

On Monday, Alphabet Inc.’s Google announced it will not submit a bid for the 10-year, $10 billion single-vendor DoD JEDI cloud contract because it may present potential conflicts with its AI principles. The withdrawal comes only a few months after the company decided it will not renew its AI contract with the DoD following significant internal complaints from employees. Google said they would have submitted a compelling solution for the portions that align with its values and fall within its scope had the contract been open to multiple vendors. The company was among a handful of tech giants in the hunt for the cloud contract, including Amazon Web Services, Microsoft Azure, IBM, GDIT (formerly CSRA) and Oracle—many of which have also expressed their displeasure with the winner-take-all award structure. In related news, this Wednesday, IBM filed a pre-award protest on JEDI, following Oracle’s pre-award protest of the contract earlier in the year. IBM is challenging the contract’s request for a single cloud environment for 10 years, as well as the RFP’s stringent requirements, which “mirror one vendor’s internal processes” and “restrict the field of competition”, according to IBM General Manager Sam Gordy. The final deadline for bids is Friday, with the awardee to be selected next April unless the protests cause the timeline to be extended.

This past week, the Government Accountability Office (“GAO”) released a report detailing a series of cyber vulnerabilities associated with the Department of Defense’s (“DoD”) portfolio of weapon systems. Because automation and connectivity are fundamental enablers of the DoD’s military capabilities, the potential for cyberattacks poses a serious threat to all network-based weapon systems. According to the report, testers attempting to breach weapons systems routinely were able to gain access to a variety of network connected defense platforms, within one hour; and were then able to take full control of, after a day, manipulating the platform’s system by changing or deleting data. With the report heavily criticizing defense officials for their lack of foresight in developing cyber capabilities for weapon systems, the Pentagon will have to move quickly to address these vulnerabilities. As the GAO prepares to brief Congress on its classified findings, the DoD will receive yet another reminder of the importance of increased cyber functionality and the proactive development of systems to keep up with rapid technological changes.

Big Movers

Astronics Corporation (down 20.7%) and Triumph Group (down 15.6%)– Share prices were among the hardest hit in the Aerospace, Defense and Government Services market after this week’s selloff, which resulted in the worst week for U.S. stocks since March.

Transactions

AE Industrial Partners has acquired The Atlas Group, a provider of manufactured complex assemblies for commercial, business, and military aircrafts. Terms of the deal were not disclosed.

Celestica, Inc. has agreed to acquire Impakt Holdings, a provider of manufacturing solutions for leading OEMs. The deal is worth an estimated $329 million.

Cognosante, LLC has acquired J.Lodge, LLC, a provider of integrated solutions that improve the customer-care experience using artificial intelligence, driven speech analysis, and industry-leading software to analyze contact center interactions and find insights. Terms of the deal were not disclosed.

Decision Point Corporation has acquired CORTEK, Inc., a provider of systems engineering, software engineering, cyber support, and technical analysis and documentation to the Department of Defense, Department of State, and other government agencies. Terms of the deal were not disclosed.

FLYHT Aerospace Solutions Ltd. has acquired the Assets of Panasonic Weather Solutions, a provider of satellite communications systems, aircraft tracking, and Tropospheric Airborne Meteorological Data reporting. The deal is worth an estimated $8.4 million.

Maximus, Inc. has agreed to acquire the Citizen Engagement Centers divestiture of General Dynamics Information Technology, Inc.,a provider and operator of centers that handles government services inquires and management. The deal is expected to be worth an estimated $400 million.

Ravn Air Group has agreed to acquire Assets of Peninsula Airways, Inc., a provider of airline operating schedule passenger and charter throughout Alaska. The deal is worth an estimated $12.3 million.

Seemann Composites, Inc. has acquired Materials Sciences Corp., a provider of products and services to study advanced materials and structures. Terms of the deal were not disclosed.

TransDigm Group, Inc. has agreed to acquire Esterline Technologies Corp., a provider of engineered products and systems for aerospace and defense customers. The deal is worth an estimated $4.064 billion.

Industry Week in Review – October 05, 2018

/in Week In Review/by kippsdesantoKippsDeSanto & Co. Industry Week in Review – October 5, 2018

Summary

Updates and overhauls continue to stand out as prevalent trends in the Aerospace, Defense, and Government Technology communities. This week, the U.S. Army came closer to finding a supplier for its defense radar system, and Boeing and Embraer mentioned the prospect of building an assembly line for Embraer’s cargo aircraft to make up for lagging interest from Brazilian buyers. In the Government Technology sector, digital transformation remains a pressure point as agencies pursue alternative avenues to facilitate cloud modernization and increased cyber functions.

Aerospace & Defense Update

The U.S. Army has narrowed its selection of awardees to develop a next-generation air and missile defense radar (“AMD”) system to Raytheon and Lockheed Martin. The Department of Defense Ordnance Technology Consortium originally had awarded contracts to four companies to develop designs for the Patriot AMD radar replacement system but has removed Northrop Grumman’s and Technovative Application’s from the process. The concept design contracts were given a period of performance of 15 months, but the down-select came early. Raytheon currently manufactures the legacy Patriot System while Lockheed Martin currently is developing the Medium Extended Air Defense System as competition. Radar technology is becoming more prevalent as Congress has mandated that the U.S. Army find a way to produce more capable radars that will fit into the future Integrated Air and Missile Defense framework by 2025.

Boeing and Brazilian aerospace company, Embraer, are reportedly discussing the prospect of building an assembly line for Embraer’s KC-390 cargo planes in the United States. This discussion comes on the heels of Boeing’s 80% stake in Embraer’s commercial business, and it is widely speculated that a similar deal on the companies’ defense businesses might be negotiated in the coming months. Boeing and Embraer had previously established agreements in 2012 and 2014, but a defense-related joint venture would allow for the development of much broader market opportunities. The KC-390 is a multi-mission aircraft built to haul cargo, transport passengers, insert special operators, and even help refuel other aircraft. Embraer has struggled to draw serious interest from international buyers as Brazil currently remains its only customer, however Embraer believes this agreement could change that.

Government Technology Solutions

With their innovative and agile solutions offerings, commercial companies have begun to increase their desire to more effectively penetrate the federal contracting space. This is largely driven by a change in the historic reluctance of federal agencies to adopt commercial technologies, given a heightened focus on, and need for, more robust cybersecurity measures and enhancements to outdated legacy systems. Government contractors have turned to partnerships with commercial companies in order to more quickly deliver commercial solutions as contractors typically have required contracting vehicles in place. Raytheon (NYSE: RTN) has been one of the leaders in this movement and recently teamed with Florida-based Cybraics, Inc. and California-based Authentic8, Inc., to deliver cyber and cloud solutions to federal and state and local agencies. Intended solutions include enhanced security for various voting and healthcare platforms. These companies will provide their services through a subscription model, deemed cyber-as-a-service, that will allow Raytheon “to deliver security faster and at a lower total cost,” according to John DeSimone, Vice President of Cybersecurity and Special Missions at Raytheon’s Intelligence, Information, and Services (“IIS”) segment. With government spending at all-time highs, Raytheon’s decision to collaborate with innovative commercial companies could give it a serious competitive advantage as the demand for departmental IT overhauls continues to grow.

On Thursday, the senate passed a bill that solidifies the role of the Department of Homeland Security’s (“DHS”) Cybersecurity and Infrastructure Security Agency (“CISA”). Formerly known as the National Protection and Programs Directorate (“NPPD”), the agency was rebranded amid increasing cyber threats and tasked with securing federal networks and protecting critical infrastructure. The elevation of CISA comes in the wake of a long line of cyber breaches, including alleged Russian meddling in the U.S. election in 2016 and the recent Chinese hardware hack that made its way into Apple and Amazon Web Services’ data center equipment. This move, coupled with the recent passage of the Cyber Deterrence and Response Act in September, further reinforces U.S. prioritization of combatting the increasing cyber vulnerability of federal agencies and commercial companies as they modernize.

Transactions

Air Transport Services group, Inc. has agreed to acquire Omni Air International, LLC, a provider of airline and charter services for commercial and government clients. The transaction is worth an estimated $845 million.

Artech Information Systems, LLC has acquired The Talent & Technology Solutions Business Unit of CDI Corporation, a provider of IT and engineering talent sourcing services and technology solutions to clients across North America. Terms of the deal were not disclosed.

Behrman Capital has acquired kSARIA, a provider of mission-critical connectivity solutions for the aerospace and defense end markets. Terms of the deal were not disclosed.

Bel Fuse, Inc. has acquired BCMZ Precision Engineering Limited, a provider of precision machined components to customers in the automotive, aerospace, defense, telecommunications, fiber optic, and medical industrial sectors. Terms of the deal were not disclosed.

Bytecubed, LLC has acquired InterKN, a provider of proprietary technology platforms that connect enterprise buyers with innovative suppliers by dynamically surfacing available funding, technology needs, and data insights. Terms of the deal were not disclosed.

Gulfstream Aerospace Corp. has acquired a manufacturing line of The Nordham Group, Inc., a provider of nacelles for the Gulfstream G500 and Gulfstream G600. Terms of the deal were now disclosed.

Enlightenment Capital has made a strategic investment in Emagine IT, Inc., a provider of information technology services, with a focus on cyber, data analytics, and cloud, to government and commercial customers. Terms of the deal were not disclosed.

Hilcrest Holdings, Inc., in partnership with Akoya Capital, LLC, has acquired Evolver, Inc. and eVigiliant Security, merging the two to create Converged Security Solutions (“CSS”), a provider of comprehensive converged security managed services solutions spanning cyber and physical security. Terms of the deal were not disclosed.

Standex International Corp. has acquired Regional Mfg. Specialists, Inc. (d.b.a. Agile Mechanics), a provider of high-reliability magnetics, including transformers, inductors, and coils for mission critical applications for blue chip OEMs. The transaction is worth an estimated $39 million.

Industry Week in Review – September 28, 2018

/in Week In Review/by kippsdesantoKippsDeSanto & Co. Industry Week in Review – September 28, 2018

Summary

Boeing has been awarded a $9.2 billion contract from the Air Force to supply next-generation training jets. Furthermore, commercial technology companies continue to penetrate into the government contracting market. This week the Air Force announced it will award AT&T and Microsoft cloud Other Transaction Authority (“OTA”) contracts worth up to $121.7 million.

Aerospace & Defense Update

The Air Force announced that it had selected a bid by a Boeing-Saab partnership for the award of a $9.2 billion contract to supply next-generation training jets. This is expected to be the Air Force’s last major aircraft procurement opportunity for the foreseeable future. The Air Force plans to purchase 351 T-X aircraft, 46 simulators, and associated ground equipment with an option to buy up to 475 aircraft and 120 simulators. The new aircraft will provide Air Force pilots with critical training capabilities required to increase operational efficiency. Boeing’s award is its third major contract victory since August, following an $805 million Navy contract to build four MQ-25 unmanned tankers and a $2.38 billion Air Force contract to manufacture Huey replacement helicopters.

Boeing and Lockheed Martin’s joint venture, United Launch Alliance (“ULA”), has chosen Jeff Bezos’ space industry startup, Blue Origin, to provide its BE-4 engine for ULA’s upcoming Vulcan rocket. The first launch of ULA’s Vulcan is tentatively scheduled for 2020, but testing and final certification may push back that date. ULA estimates the project will create over 20,000 direct and indirect jobs. The potential billion-dollar agreement is an important stepping stone for Blue Origin as it seeks to become a major military launch provider. Blue Origin’s penetration into the military launch systems market comes amid significant military and commercial activity in the space industry. The Air Force is seeking to procure a wider range of lower-cost, more diverse launch systems, providing private sector billionaires such as Bezos and Elon Musk an opportunity to expand their presence in the growing space launch markets.

Government Technology Solutions

Commercial technology players continue the push to gain significant presence in the government contracting market, a strategy reinforced by Amazon CEO Jeff Bezos’ presence at Wednesday’s annual Air, Space and Cyber Conference. Mr. Bezos used the platform to encourage the government to leverage more commercial technology, which tends to provide a broad range of solutions to a diverse population of customers, rather than buying what he views as more narrow, costly solutions from traditional federal contractors. The main discriminator for commercial entities, according to the Amazon CEO, is the number of co-customers and strong ecosystem of users they serve that constantly drive innovation and the product forward. The recent wave of large federal contract wins by commercial companies suggests agencies recognize the benefits Bezos alluded and are increasingly becoming more open to adopting commercial technology for their modernization requirements. Amazon is not the only successful commercial player in the federal contracting space, however; the Air Force announced this week it will award AT&T and Microsoft $121.7 million in cloud Other Transaction Authority (OTA) contracts in an effort to modernize IT infrastructure and create a more efficient workforce within the department. Furthermore, commercial contractors are not only winning awards but also beginning to exert influence and earn meaningful seats at the industry table. This week, White House officials announced they will host representatives from IBM, Alphabet Inc., and AT&T on Monday for a quantum information science (“QIS”) summit as agencies continue to look towards NextGen solutions to improve overall efficiency and mission delivery. As the 2018 government fiscal year draws to a close, commercial companies should expect to see the uptick in market share continue moving into 2019.

Transactions

A portfolio company of H.I.G. Capital has acquired Iron Bow Technologies, LLC, a provider of information technology solutions worldwide that serves clients in the government, healthcare, higher education, legal, and non-profit industries. Terms of the deal were not disclosed.

L3 Technologies has acquired ASV Global, a provider of unmanned surface vessel and autonomous vessel control systems

Industry Week in Review – September 21, 2018

/in Week In Review/by kippsdesantoKippsDeSanto & Co. Industry Week in Review – September 21, 2018

Summary

Increased defense spending continues to be a primary emphasis for the federal government. Multiple branches of the military have received or will receive increased funding in the foreseeable future. Furthermore, IT modernization and heightened security continues to be an ongoing area of focus for the both the commercial and federal end markets.

Aerospace & Defense Update

U.S. Army weapons and munitions technology development is receiving a large-scale cash injection in the recently passed GFY2019 spending bill, which was passed much earlier this calendar year than in 2018. (“RDT&E”) dollars for weapons and munitions technology increased by $343 million in the bill, representing more than the $40 million in RDT&E funding that the Army had previously requested for 2018. Even though the Army’s budget request had dropped in February of this year, the service has been proactive by forming cross-functional teams to tackle top modernization priorities. These teams are essential to rapidly modernize forces to go up against adversaries such as Russia and China with top priorities being long-range precision munitions and small unmanned aircraft systems.

The U.S. Air Force estimates that creating a Space Force will cost a total of approximately $13 billion over the next five years, including an initial $3 billion cost to start up this program. The proposal, put forth by the Air Force to add a sixth branch of the military, estimates that more than 13,000 personnel will be needed on top of existing space operators to help stand up the Space Force. In addition, the proposal estimates that the Space Force headquarters would be established in GFY2020, and the services would begin transferring the space personnel and programs the following year. Under the proposal, there is a possibility of re-integrating the intelligence community within the newly-formed military space community through the use of the National Reconnaissance Office.

Government Technology Solutions

In the ongoing quest for federal IT modernization and security, Microsoft and Amazon have both ramped up their federal cloud pursuits to capture part of this burgeoning market. Following the integration of Microsoft’s on-premises application software—Azure Stack—with the Azure Government Cloud in August, the Seattle-based software company intends to attract public sector clients with a hybrid cloud approach that addresses latency and connectivity locally. Along with these capabilities, Azure aspires to accelerate the IT modernization timetable, ensuring that “applications can be moved without making any changes in code, DevOps tools, processes, or people skills.” Not to be outdone, Amazon Web Services (“AWS”) established a two-part program to guide and facilitate government customers’ transitions to Amazon’s cloud platform. Amazon understands the inherent competition in such a largescale overhaul and responded to Azure’s announcement with the AWS Public Sector Partner Transformation Program, a 110-day initiative aimed at moving its clients to the cloud. As the market for modernization continues to heat up, signs point to a showdown between Amazon and Microsoft for meaningful federal cloud market share.

The American Council for Technology and Industry Advisory Council (“ACT-IAC”), a partnership that strives to modernize the government via IT implementation, held a meeting this Tuesday which assessed the potential impacts of automating government agencies’ processes. The biggest challenge is not the automation itself, but rather the optimization of legacy processes required beforehand, according to General Services Administration (“GSA”) senior advisor Ed Burrows. Once implemented, however, time and cost savings could be significant. For National Aeronautics and Space Administration (“NASA”), adopting a robotic process automation (“RPA”) for the agency’s grants management system has resulted in $50,000 in savings so far, on an initial investment of only $7,000. Further RPA initiatives at NASA are expected to continue to eliminate low-value manual work—efforts the Trump administration deems inefficient and dated. Shifting away from time-intensive, manual work and towards automation to focus on high-value tasks could potentially attract more technical and skilled graduates into the government space workforce, as evident in initiatives like Harvard’s “Code It Forward” program, which sponsored fellowships performing high-end, “civic tech” work at six federal agencies this past summer.

Transactions:

AEVEX Aerospace, a portfolio company of Trive Capital, has acquired Special Operations Solutions, LLC (“SOS”), a provider of ISR platform modification engineering, custom system design, software development, flight test services and processing, exploitation, and dissemination (“PED”) technical support for special operations in highly complex environments. The terms of the transaction were not disclosed.

BBA Aviation plc has agreed to acquire Firstmark Corp., a provider of highly engineered, proprietary components and subsystems for the aerospace and defense industries. The deal is worth an estimated $97 million.

Braidy Industries, Inc. has acquired NanoAI, LLC, a provider of the design, development, and commercialization of high-end performance aluminum alloys for a diverse set of industries. The terms of the transaction were not disclosed.

Desser Holding Company LLC, a portfolio company of Graham Partners, has acquired AOG Aviation Spares, LLC and Seinus, LLC, providers of component repair, overhaul services, and replacement PMA parts to airline operators. The terms of the transaction were not disclosed.

Kaiser Aluminum Corp. has acquired Imperial Machine & Tool Co., a provider of multi-material additive manufacturing and machining technologies for aerospace and defense, automotive, high-tech, and general industrial applications. The terms of the transaction were not disclosed.

Modern Aviation, a portfolio company of Tiger Infrastructure Partners, has acquired the Centennial Airport assets of Xjet Holdings, LLC, an FBO with more than 50,000 square feet of climate-controlled hangar accommodation. The terms of the transaction were not disclosed.

NewSpring Holdings LLC, the holding company of NewSpring, has acquired The Sentinel Company, a provider of mission-focused consulting and technology-enabled solutions to customers within national security domains. Terms of the deal were not disclosed.

Planned Systems International has acquired KINEX, Inc., a provider of mission-critical technology, modeling and simulation, software development, cybersecurity and data solutions to the Department of Defense (“DoD”) and Intelligence Communities. The terms of the transaction were not disclosed.

Snow Phipps Group has acquired Blackhawk Industrial Distribution, Inc., a provider of cutting tools, abrasives and industrial MRO products used in manufacturing, aerospace & defense, energy, and many other diverse markets. The terms of the transaction were not disclosed.

System One has acquired TPGS, a provider of software engineering and IT consulting for the Department of Defense and intelligence agencies. The terms of the transaction were not disclosed.

Timken Co. has acquired Rollon Group, a provider of the design and manufacture of engineered linear guides, telescopic rails, and linear actuators used in a wide range of industries including the aerospace industry. The terms of the transaction were not disclosed.

Vision Technologies Aerospace, Inc. has acquired MRA Systems, LLC, a provider of the design, development, production, and sale of nacelle systems and their thrust reversers for both narrow-body and widebody aircraft. The deal is worth an estimated $630 million.

Industry Week in Review – September 14, 2018

/in Week In Review/by kippsdesantoKippsDeSanto & Co. Industry Week in Review – September 14, 2018

Summary

Boeing CEO Dennis Muilenburg addresses the production slowdown of 737 aircrafts—announcing the company will ramp up monthly production by almost 10% in 2019. Congress approved an additional 16 F-35 Joint Strike Fighters, increasing the authorized 2019 total by over 20%. SAIC’s acquisition of Engility, valued at nearly $2.5 billion, continues the trend of public company government contractors turning to mega-mergers and acquisitions to scale.

Aerospace & Defense Update

At Boeing’s September 12th investor conference, Boeing CEO Dennis Muilenburg appeared confident that 737 aircraft production would recover by year-end with no effect on Boeing’s financial forecasts. As he has mentioned previously, Muilenburg emphasized that the 737 delivery slowdown stemmed from a combination of the latest production-rate ramp-up occurring simultaneously with the production line shift to the MAX variant of the 737. In response to a possible slowdown, Boeing has added about 600 new 737 production workers in recent months, and these workers are expected to stay on as Boeing looks to ramp up its a production rate from 52 aircraft to 57 aircraft per month by next year. Muilenburg expressed that the 737-aircraft line will continue its year-over year growth and Boeing will not need to alter its 2018 forecast.

Congress has approved the addition of another 16 F-35 Joint Strike Fighters on top of the 77 authorized by the 2019 defense policy bill. As usual, appropriators used their annual defense spending bill to offer tweaks to the existing shopping list for military hardware from the previous version of the bill, which President Trump signed into law last month. This new compromise also adds an extra littoral combat ship and six more Bell-Boeing V-22 Ospreys to build a stronger military force moving forward. In all likelihood, these measures are expected to pass before the start of the fiscal year on October 1st to avoid the optics of a government shutdown ahead of upcoming midterm elections in November.

Government Technology Solutions

This past week, Science Applications International Corporation (“SAIC”) announced its intentions to acquire Engility Holdings, Inc. (NYSE:EGL). Engility was spun out from L3 Communications, Inc. (“L3”) in 2012 and proceeded to acquire Dynamic Research Corporation (“DRC”) and The Analytic Sciences Corporation, Inc. (“TASC”) in 2014 and 2015, respectively. SAIC’s acquisition of Engility, valued at nearly $2.5 billion, will position SAIC as the third-largest contractor by revenue in the Government Technology Solutions space. SAIC is the latest in a long line of public company government contractors who have turned to mega-mergers and acquisition in order to achieve increased scale and meaningful cost synergies in today’s active, yet competitive, marketplace. Other notable recent deals of scale in the industry include: DXC Technology’s three-way merger with Vencore and KeyPoint creating Perspecta, Inc., General Dynamics’ $9.7 billion acquisition of CSRA this April, and Leidos’ $4.6 billion acquisition of Lockheed Martin’s IT business in 2016. This race to acquire scale, contracts, and capabilities, stoked by increased government spending and favorable budgetary dynamics, is expected to continue in the near to medium-term. In an investor conference call, SAIC CEO Anthony Moraco said that the combination of SAIC and Engility is a strategic move that “take[s] advantage of near-term market opportunities in this federal market environment, but also provide[s] downside protection against perturbations in the longer-term funding profiles of individual customers.” While integration will likely be the initial focus, the union of these large service providers will also provide SAIC access to Engility’s security cleared labor force. Adding these extra cleared workers will boost SAIC’s ability to compete for new work and allow it to pursue larger contracts as a result. Like SAIC, other large government contractors are turning to M&A to broaden capabilities and customer portfolios in order to access more of the broader market.

Big Movers

Triumph Group, Inc. (up 11.2%) – Share prices were up this week due to winning two contract extensions for HELLFIRE Romeo Missile Components, which are expected to generate more than $11 million in revenue.

SAIC (down 11.5%) – Share prices were down this week following an announcement that SAIC has agreed to acquire Engility Holdings, Inc. and will assume Engility’s $900 million in debt.

Transactions

SAIC has agreed to acquire Engility Holdings, Inc., a provider of technical services to the U.S. Department of Defense, U.S. Department of Justice, U.S. Department of State, Federal Aviation Administration, Department of Homeland Security, and space-related and intelligence community agencies. The deal is worth an estimated $2.5 billion.

Argosy Capital has acquired Capewell Aerial Systems, a provider of engineering products for aerial delivery, life support, and tactical gear for military, law enforcement, and humanitarian agencies.

Coriolis Composites has acquired MF Tech, a provider of robotic filament winding, a technique used to manufacture a wide variety of composite parts.

TAE Aerospace Pty. Ltd acquired Kiddie Aerospace and Defense Australia Pty Ltd., a provider of automatic fire extinguishing systems for military vehicles used by armed forces.

KippsDeSanto & Co.

1675 Capital One Drive

Suite 1200

Mclean, VA 22102

Phone: 703.442.1400

Fax: 703.442.1498

Check the background of KippsDesanto & Co on FINRA’s BrokerCheck